Tariffs have become a central concern for distributors using Prophet 21 (P21), especially in today’s rapidly shifting economic and political climate.

At a recent distributor roundtable hosted by Conveyance Solutions, experts and users gathered to discuss practical strategies for managing tariffs in P21, share survey insights, and tackle tough edge cases.

The companion deck for this roundtable can be downloaded here: Navigating Tariffs in Prophet 21 Roundtable.

Key Takeaways:

-

Multiple Approaches: There is no single “best” way to handle tariffs in Prophet 21—options range from manual entry to automation, each with trade-offs in accuracy, visibility, and effort.

-

Customer Communication: How and when to show tariffs to customers is a major decision; options include line-level, subtotal, or hidden charges.

-

Manual vs. Automated: Automation can reduce manual work but requires custom development and ongoing maintenance.

-

Edge Cases Matter: Special scenarios like assemblies, direct shipments, and split releases require extra attention and creative solutions.

-

Tax & Accounting: Proper setup is crucial to ensure tariffs are handled correctly in your GL and tax calculations.

-

Flat Fee Option: Applying a flat tariff charge per order or customer can simplify processes in volatile environments.

What are Tariffs?

Tariffs are taxes applied to goods brought in from other countries.

When tariffs increase the cost of these goods, businesses often pass the extra expense on to their customers.

The Reality of a Rapidly-changing Environment

For distributors, managing tariffs is more than a line item—it’s a moving target. Tariff rates, applicability, and regulations can shift quickly, requiring ongoing attention and adaptation.

There is no one-size-fits-all solution in Prophet 21.

Our experience shows that users must continually balance avoiding financial losses, maintaining process efficiency, ensuring accuracy, and reducing manual work.

The upcoming Epicor 25.1 release may offer some relief, but for now, users must rely on a mix of manual processes and creative workarounds.

Key Questions about Tariffs

Before implementing any solution, distributors should consider:

-

How accurate do tariff charges for customers need to be?

-

How should tariff costs be recognized (as a separate General Ledger expense or as part of inventory/COGS)?

-

How much visibility should customers have into tariff charges?

-

How much manual maintenance is acceptable given ongoing uncertainty?

Before our roundtable, we surveyed 50 distributors which revealed several trends:

-

Passing on Tariff Costs: All respondents pass on tariffs to customers in some form.

-

Accounting for Tariffs: Most prefer to treat tariffs as a separate GL account rather than including them in COGS.

-

Customer Visibility: The majority of respondents want some level of customer visibility, with preferences split between showing tariffs at the line level and at the subtotal level. A minority prefer tariffs to be invisible to customers.

Handling Tariffs in Prophet 21 Manually

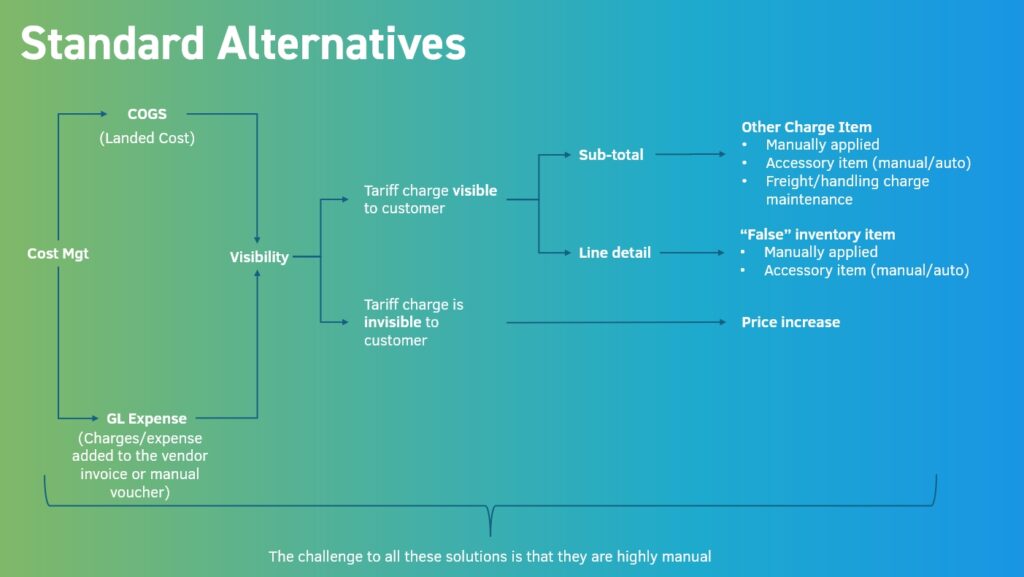

While there is no “one-size-fits-all” approach, we put together a decision tree to help guide your tariff strategy.

Costing Options:

-

General Ledger Expense: Tariffs are tracked as a separate expense, not affecting item costs.

-

Landed Cost: Tariffs are included in inventory cost, impacting moving average and COGS.

Visibility Options:

-

Visible to Customers:

-

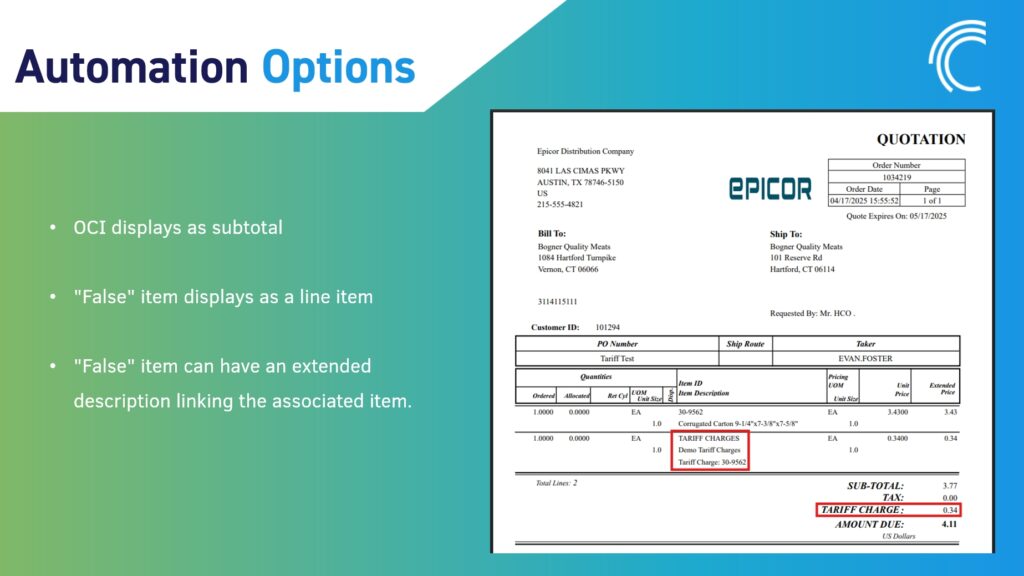

Subtotal Level: Use “other charge items.” These can be added to the order manually or via accessory items or freight/handling charge maintenance to automate charges at the subtotal level. Note: Charges typically appear only on the first invoice if there are multiple shipments unless release schedules or a manual process at shipping are used.

-

Line Item Level: Use a “false inventory item” (high-quantity item adjusted in at zero cost) to represent tariffs per line. This allows more granular control and custom descriptions. These can be added to the order manually or via accessory items.

-

-

Invisible to Customers: Bake tariffs into item prices via a price increase, which may require restructuring pricing groups to accommodate different tariff amounts.

All these approaches require significant manual setup and ongoing maintenance, especially as tariff rates and applicability change.

Automations in Prophet 21

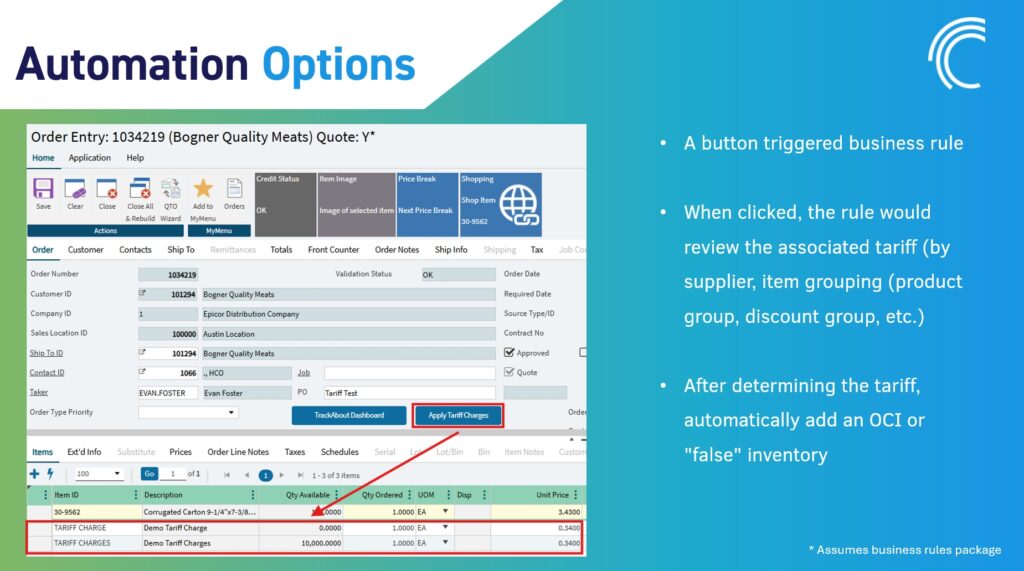

Automation can ease the manual burden but requires custom development:

-

Business Rules: Add custom buttons or triggers in order entry or purchasing that automatically calculate and apply tariff charges based on item, supplier, or group. This can add “other charge” or “false inventory item” lines with calculated values, reducing manual entry.

-

Customization Costs: Automation is tailored to specific needs but involves additional costs and maintenance. All variables (tariff rates, item associations) still need to be managed and updated.

Talking Through Edge Cases

Assemblies: Tariffs may need to be applied at the component level if buying components, or at the assembly level if buying finished goods. Both “other charge” and “false inventory item” approaches can be adapted.

Direct Shipments: Handling tariffs on direct ships is complex, especially when orders mix warehouse and direct ship items. “Other charge” items may appear on the first invoice, but linking charges to the correct lines or shipments can require manual workarounds.

Question: If the quote contains multiple items that may carry different tariff values, how can you submit on an invoice?

-

Manual Approach: Salespeople must calculate and add a tariff line for each item, using either “other charge” or “false inventory item” methods.

-

Automated Approach: Custom rules can reference tariff percentages at the product or group level and auto-add lines, but require ongoing maintenance of tariff data and logic.

Question: Can other charge items invoice at different times if you use scheduled releases?

-

Possible Solution: Other charge items can be added to scheduled releases, potentially allowing them to invoice with specific shipments. However this method requires every item and other charge to be grouped into multiple releases and will require multiple order changes.

Question: Can you do an automation trigger on purchase orders?

-

Yes: Business rules in P21 can be set up to trigger automation on purchase orders.

Question: How do you manage other charge lines invoicing along with the correct lines in general if there are multiple shipments?

-

Other Charge Item: Add other charge items to the order or create a scheduled release. This is a manual process and can become cumbersome with many items.

-

False Inventory Items: These offer more flexibility for matching charges to shipments but require warehouse staff to process non-physical items, which may not be ideal.

Question: What are the tax implications around tariff lines on customer orders?

-

-

Tax Settings: In P21, you can set whether a tariff line (other charge or inventory item) is taxable or non-taxable by adjusting tax groups in item maintenance. This applies regardless of the chosen method. Integration with Avalara or similar tax engines allows further control, but the specifics of whether tariffs should be taxed depend on legal and business requirements.

-

For more information on how sales tax can affect tariffs refer to this overview of taxes and tariffs or consult a tax expert.

Approaches to Communicating Tariffs to Customers

-

Add explanatory notes to invoices, quotes, and acknowledgments.

-

Update terms and conditions to state that tariffs are subject to change and may be added.

-

Use automated emails to notify customers of tariff-driven price changes.

Flat Charges by Order, Customer, or Supplier

A practical, low-maintenance alternative is to apply a flat tariff charge:

-

Flat Fee: Calculate an average tariff and apply it per order, customer, or supplier.

-

Automation: Flat charges can be automated with business rules or set as the price for an “other charge” item. Freight or handling charges support this behavior with no custom development or add-on products.

-

Pros and Cons: This approach sacrifices some accuracy but greatly reduces maintenance and complexity. It is a viable option in highly volatile environments.

How Conveyance Can Help

There is no perfect solution for managing tariffs in Prophet 21—each approach involves trade-offs between accuracy, visibility, manual effort, and automation. As the environment evolves and new software releases emerge, distributors must remain flexible, continually reassess their processes, and be prepared to adapt their tactics as needed.

Ready to see the difference a Platinum Partner can make?

Learn more about how we can help make data work better for you.